Trust is everything when you’re looking for help with debt. As a leading Scottish debt solutions provider, we’ve always been proud of our customer feedback. We’re extremely proud that Trust Deed Scotland® reached a new milestone of 10,000 TrustPilot reviews. In a 2023 survey, 98.8% of our customers told us that they felt satisfied or better, with their choice of debt solution.

Trust Deed Scotland® also have more 5 Star TrustPilot reviews than all other Trust Deed providers combined.

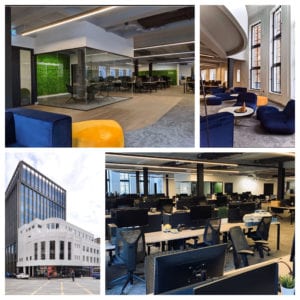

Scotland’s leading Trust Deed advice company moves into our first office in Glasgow’s Finnieston area.

Scotland’s leading Trust Deed advice company moves into our first office in Glasgow’s Finnieston area.