Article written in 2016. Some terminology may have changed since then. If in doubt, contact us for clarity and the most recent interpretation of the information provided.

The latest government Protected Trust Deed data indicates that Scottish Trust Deeds are on the rise in Scotland. But what does that mean for Scottish people?

Let’s look at the insolvency statistics for Scotland this year, and find out.

How Do the Insolvency Statistics Differ from Those in Previous Years?

The government’s insolvency statistics for Scotland in the third quarter (July to September) of 2016 show that:

⚫ The number of individual insolvencies increased by 8.5% compared to the third quarter of 2015, with 2,424 recorded.

⚫ The number of individual sequestrations (bankruptcy) increased by 15.3% compared to the third quarter of 2015.

Of the 1,113 in Q3 this year, 471 people went into sequestration through the Minimal Asset Process route.

This replaced the LILA route (Low Income, Low Assets) in April 2015, which has led to a general decrease in sequestration filings.

⚫ The number of individuals applying for a trust deed increased by 3.3% compared to Q3 2015, with 1,311 filings.

⚫ The figures for all three quarters also display that for the first time in a long time, significantly more people have been filing for trust deeds than sequestrations.

Looking at the figures for Q2 2016, the 1,261 trust deed filings saw a 48.5% rise compared to Q2 2015, while Q1 2016’s 1,235 was an increase of 48.1%.

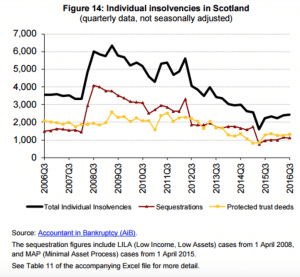

The rise in 2016, and how it compares to previous years, can be seen with ease on this graph of the Q3 data for individual insolvencies. While the numbers of individual trust deeds have occasionally matched or very minutely exceeded the number of sequestrations, the last time we saw this kind of change was back in 2007.

Why Have Scottish Trust Deeds Exceeded Sequestrations?

Insolvency legislation has recently changed with regard to the minimum period for contributing to your insolvency estate. While Sequestration‘s used to require a minimum period of three years, now both Sequestrations and Trust Deeds demand a minimum of four.

This is most likely the reason for the rise in trust deeds – with no difference in the period of contribution, people are choosing the more positive option of a Trust Deed, than straightforward bankruptcy.

How Many People Have Applied For Trust Deeds?

Looking at the data from Q1, Q2 and Q3 together, you’ll see that 7,061 Scottish people have filed for bankruptcy so far this year, yet only about 4,000 have applied for a Trust Deed.

This shows that we need to be reaching those other 3,061 people to try and show that Trust Deed Scotland is a strong alternative (as long as the debt is more than £5,000).

What Is A Scottish Trust Deed?

If you’re asking the question of what is a Scottish Trust Deed at this stage, then the simplest explanation is that a trust deed is a voluntary arrangement whereby you effectively cover your debts through your own assets, rather than going into sequestration.

Your contribution to your trust deed is based on how much disposable income you have once your living costs have been deducted from your income. To be eligible for a trust deed you have to be a Scottish resident with £5,000 or more unsecured debt.

Can You Get A Scottish Trust Deed Twice?

Yes. You can apply for a Scottish Trust Deed twice, and it is not uncommon for people to fall into financial difficulties again after originally clearing debts using this tool.

Statistically, it is rare for individuals to need a second Trust Deed but such is life, some people may find themself in a similar position.

You can have 2 Scottish Trust Deeds, but you must also be discharged from the first Trust Deed which means that the first Trust Deed has ended, either because it failed or you had complete the term.

If you have failed a Scottish Trust Deed and you’re looking at being discharged – it’s important that all factors are considered and alternative solutions discussed.

Trust Deed Scotland offer non-judgemental confidential advice and advise you to give us a call on 0141 221 0999.

What Does This Mean For Scottish People?

As we discussed earlier, the change in legislation for declaring yourself bankrupt has seen a rise in people filing for a trust deed. Many people who are in debt are happier once they have a trust deed, as it means that you are only making one payment a month to one body, rather than several to different creditors.

Those who set up a Scottish Trust Deed with Trust Deed Scotland should also be confident that they are receiving support which puts them first – as evidenced by our no.1 rated status.

With a less negative connotation than Sequestration, and support which puts people, not money, first, this rise in Scottish Trust Deeds should help to remove the stigma of being in debt, and show that bankruptcy is not the only option.

For free, impartial Debt Advice In Scotland – call 0141 221 0999